Child Tax Credit Update Portal: A Quick Guide

The Child Tax Credit Update Portal (CTC Up) allows taxpayers to verify their eligibility and update information for the advance Child Tax Credit monthly payments, which start this month.

Currently, taxpayers may use CTC Up to see a list of their future payments. They may also unenroll from payments if they prefer to receive a lump sum when they file their 2021 tax return next year. The most recent update to CTC Up allows taxpayers to make changes to their bank information for their payments.

The IRS will continue to add new functions to CTC Up. Taxpayers will be able to change their address by early August. By late summer, taxpayers will be able to update information regarding their dependents, marital status, and income. They will also be able to re-enroll if they previously unenrolled from advance payments.

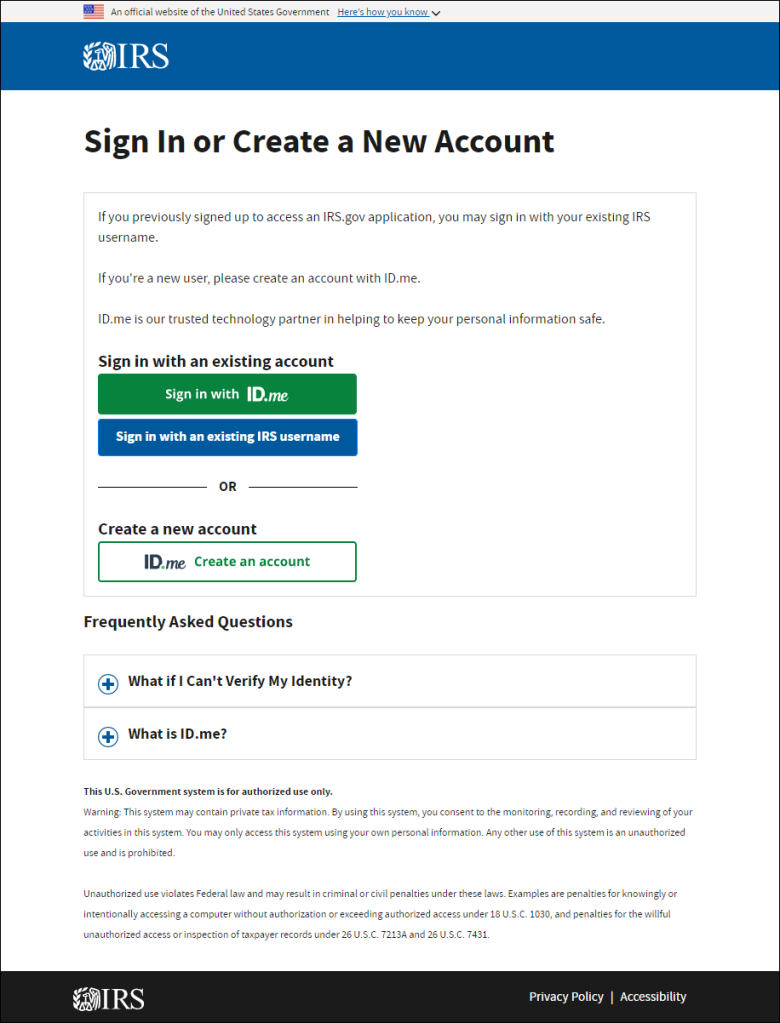

To access the portal, taxpayers must verify their identity. Taxpayers may sign in with their existing IRS username or an ID.me account. If taxpayers do not have an account, they will need to verify their identity using photo identification through ID.me.

Still have questions?

If you need assistance with the advance Child Tax Credit, please contact Indiana Legal Services’ Low Income Taxpayer Clinic by phone at (812) 961-0011 or by email at taxclinic@ilsi.net.

Wei-Chung (Lucas) Lin

Law Intern